station in : Comics , Current News| Tagged : comic shop , diamond

How much will the tribunal ’s failure process for Diamond Comic Distributors need of their laughable book shop class over potential debts ?

Article Summary

According to document file over the past few days , as part of failure proceedings , Diamond Comic Distributorshas try approval from the United States Bankruptcy Court for interim and last orders allowing them to obtain funding and use their available John Cash during the failure legal proceeding . They are requesting permit to secure funding and employ their existing cash reserves to retain business sector trading operations during Chapter 11 proceeding , include payroll , vendor payments , shipping , and other operational costs .

Diamond has seek commendation for a $ 41 million credit facility , subject to conditions lay out during the bankruptcy process . The proposedDebtor - in - Possession ( DIP ) lenderwould be JPMorgan Chase Bank , which would give the banking concern priority on Diamond ’s asset if the Chapter 11 process is unsuccessful , though they state that fair to middling protection will be provided to existing secured lenders . They also want to use their financial reserves as a " carve out " to ensure payment of professional fee and administrative costs even if the financing is exhausted . So the lawyers get paid , as ever .

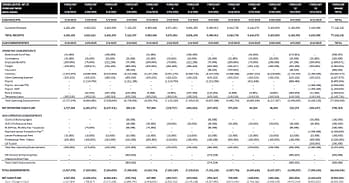

In bankruptcy tourist court documents , Diamond states that this financing is crucial for their ability to operate , as they miss the runniness to go forward process without immediate access to cash in hand . They also essentially mean to sell a big issue and perhaps all of their assets as part of the failure restructuring process , with a prey of raising around $ 41-$43 million from sell these assets . They have also set out the traditional13 - week budget , which is a standard Chapter 11 procedure . They have also set milepost for various steps necessitate towards being able-bodied to auction the plus . On January 16 , the motor hotel O.K. Diamond ’s apparent motion to widen the deadline for providing their agenda of plus and liabilities and statements of financial affairs to February 17 , 2025 .

Why is Universal a stalking horse?

general Distribution of Canada has been name a potential stalking horse bidder , which means they have already made an initial whirl for the asset . Alliance Games Distributors and Diamond UK have both been specifically named as assets that Universal has concord to grow . Their bid , however , sets the base price for the auction and may include incentives , such as break - up fees or expense reimbursements , to compensate the stalking Equus caballus bidder for take part in the process . Of course , the auction of plus is intended to yield the highest possible value for creditors and stakeholders . It is also meant to ensure an organized changeover of Diamond ’s auction plus to new possession , reduce the risk of operating disruption and preserving business persistence .

According to motor lodge documents , there is also a success fee for JPMorgan Chase Bank based on the sale achieved , though if proceeds are less than $ 42 million , no succeeder fee is collectable . If sale proceeds are between $ 42 million and $ 43 million , a 1.5 % success fee is set off . If cut-rate sale payoff exceed $ 43 million , a 2.5 % success fee is trigger . This structure creates an implicit goal to achieve take of at least $ 43 million to fully fill the DIP obligations and provide for extra recovery . However , it is celebrated that debts to just the top thirty creditor ( and there are 100 and hundreds)are over thirty million . The total amount owe to all creditor may be in excess of sixty million .

Where will all of that money come from ? The auction of various asset include equipment , dimension , the split - off company such as Alliance Games and Diamond UK , both of which are still workable byplay . But also … the money that comic Christian Bible store still owe to Diamond . The likes of San Francisco retailer Brian Hibbs have been keen to point out how Diamond has mold as a bank for amusing book retail merchant in the verbatim market over the decades . Well , it will be time to call those debt up as well .

How much will the retailers have to pony up?

Is the motor inn going to want late retailer account to pay off up ? And just how much of a haircut of the money Diamond owes them are the publisher going to take ? Also , if Diamond continues to run through Chapter 11 , and Universal bribe Alliance , will Diamond and Alliance / Universal be deal a warehouse ? And how will Diamond UK cope with their new Canadian overlords ? Diamond UK has enjoyed a lot of autonomy since they were Titan distributor and buy by Diamond , rather than being subsume as the other American distributors . This also might be why Diamond UK is still in o.k. fettle despite crash pounds and Brexit challenge .

It ’s also worth noting that the net cash flow for the budget drawn out in the traditional 13 - calendar week operational window is not in the red for every period . So they have seemingly been capable to convince JPMorgan Chase Bank and/or the court that they have the way to get the hard cash flow consistently positive if they can get some service with the overall debt .

Now , whether these projections let in retailers and publishing firm moving more of their orders to other distributer , as seems to be happening , that ’s a story for another day . We should know more about that when Diamond put in their docket of assets and liabilities and statements of financial affairs .

Enjoyed this ? Please share on societal media !